Background

Visa, a global leader in digital payments, continually works to enhance security for online transactions. As cyber threats evolved, Visa needed to address increasingly sophisticated fraud techniques to protect its users and maintain trust in its payment ecosystem.

Challenge

Visa faced persistent challenges in securing online transactions against advanced fraud methods, such as:

Social Engineering Attacks: Cybercriminals manipulated users into revealing sensitive information.

Example: Fraudsters posed as Visa customer support representatives and tricked users into providing their card details and one-time passwords (OTPs), leading to unauthorized transactions.

Credential Stuffing: Attackers used stolen login credentials to gain unauthorized access to accounts.

Example: Hackers obtained login details from data breaches and used automated bots to attempt logins on Visa’s payment systems, resulting in fraudulent transactions.

Limitations of Traditional Authentication: Standard security measures, such as passwords and two-factor authentication, often failed to detect these sophisticated fraudulent activities.

Example: Fraudsters used remote access tools (RATs) to bypass two-factor authentication by controlling a victim’s device in real-time.

To maintain the security and reliability of its payment network, Visa required an advanced fraud prevention mechanism that could effectively verify user identities without disrupting the user experience.

What is Behavioral Biometrics Pattern?

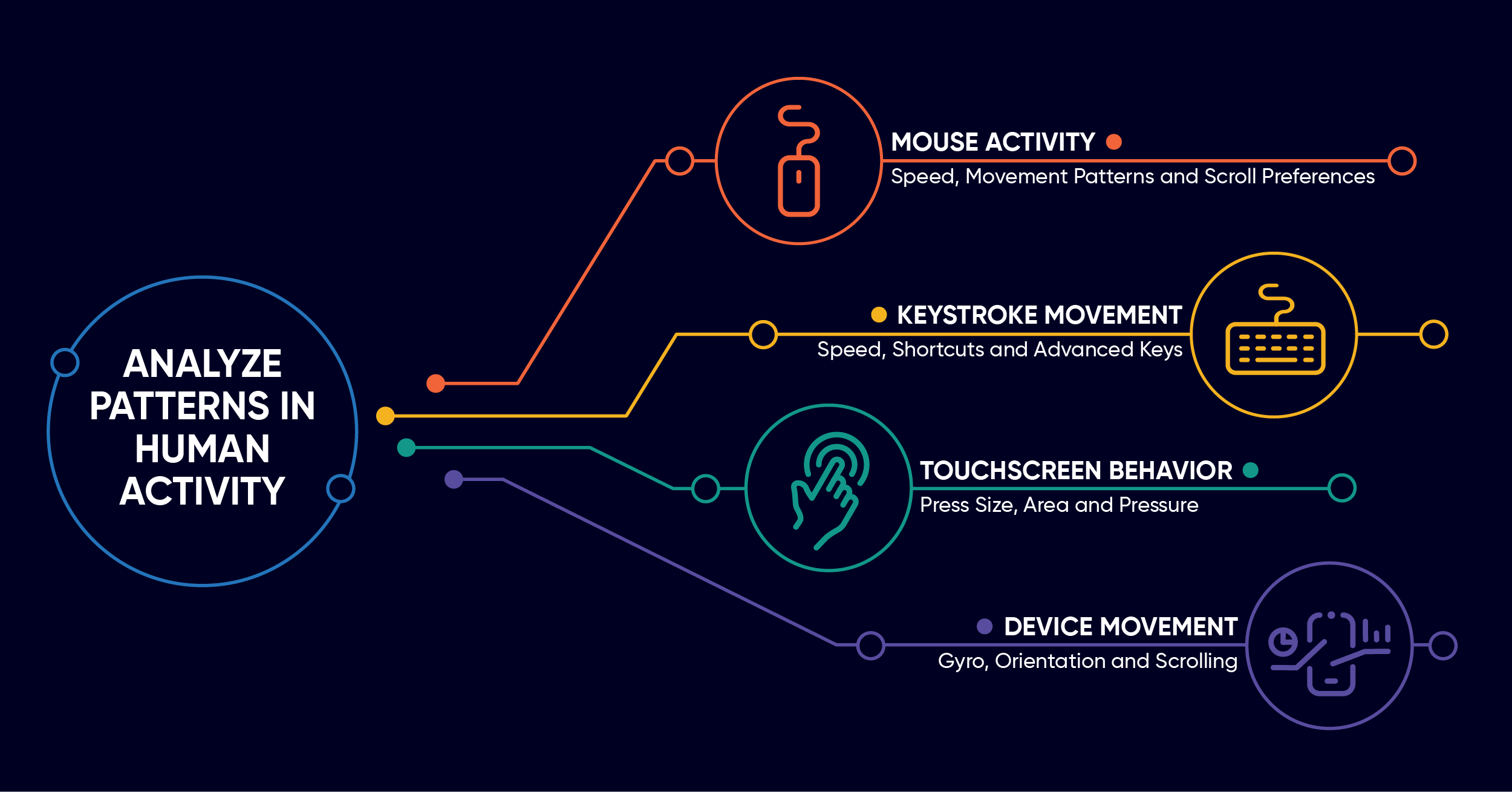

Behavioral biometrics is a passive and proactive way to identify and understand individual usage patterns at the start of a transaction so your business can: Detect signals of automation. Isolate anomalies in typical behaviors. Target typical fraudulent behavior.

Solution

Visa adopted a real-time behavioral biometrics system to strengthen transaction security. This solution leveraged artificial intelligence and machine learning to analyze and authenticate users based on their unique behavioral patterns, including:

Typing Speed & Rhythm: Each user has a distinctive typing pattern, which can be used for authentication.

Mouse Movements & Navigation Patterns: Tracking how a user moves the cursor and interacts with the website.

Device Interactions: Examining how users tap, swipe, or hold their devices.

This technology seamlessly integrated with Visa’s existing security frameworks, ensuring an additional layer of protection while maintaining a smooth and convenient user experience.

Implementation

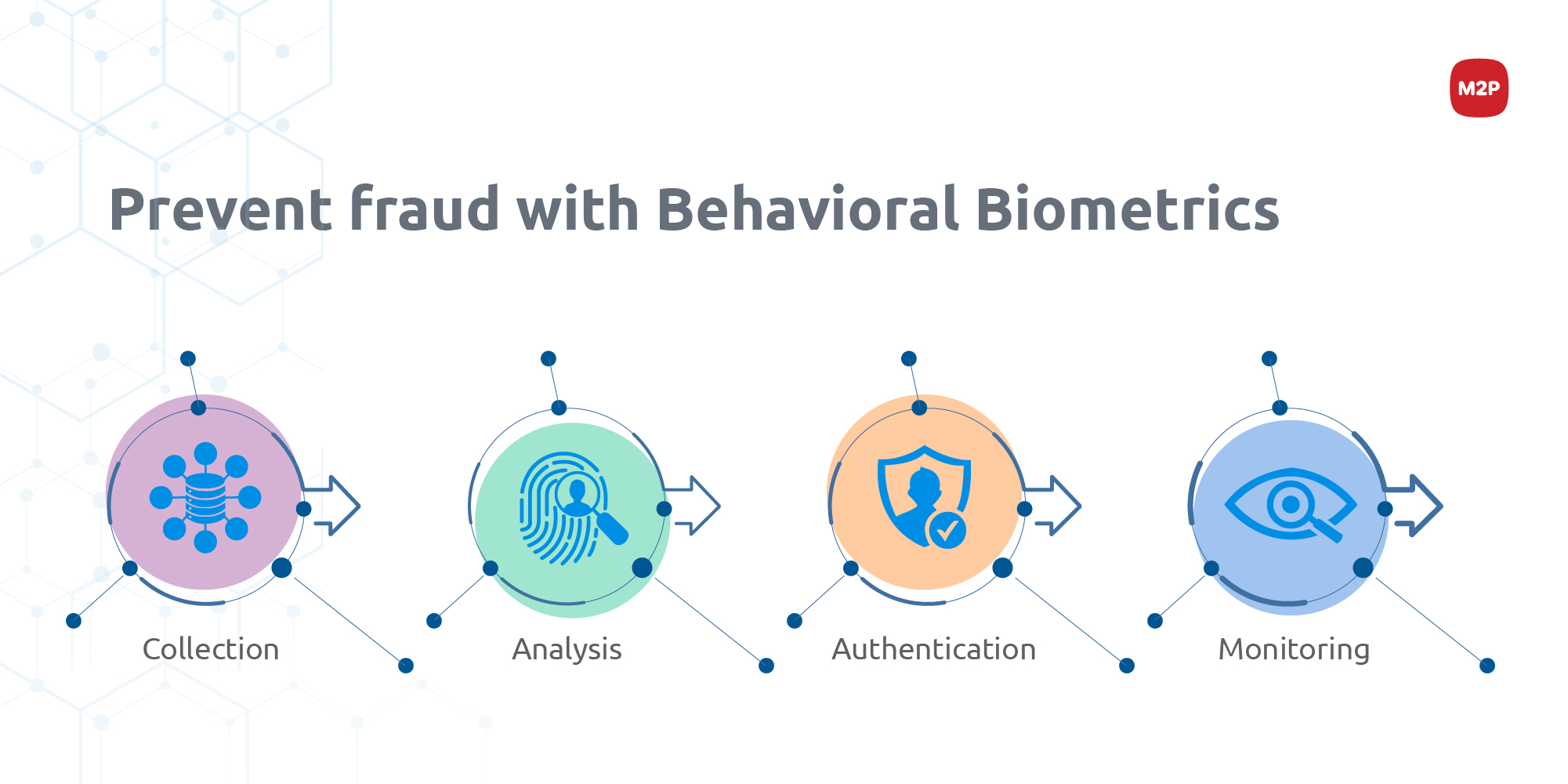

Integration with Visa’s Security Ecosystem: Behavioral biometrics were embedded into Visa’s fraud prevention system without requiring significant changes to existing infrastructure.

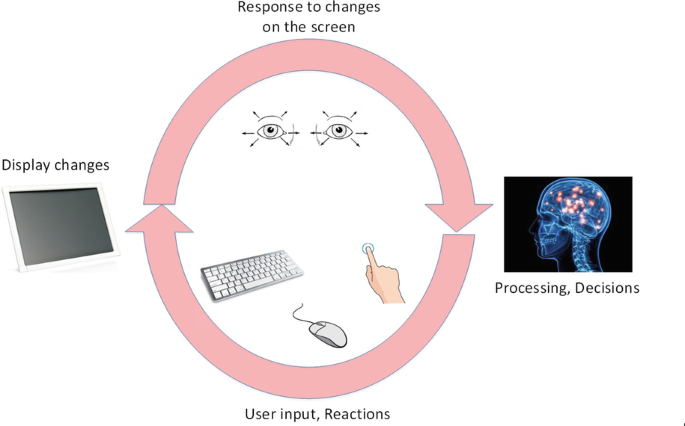

Continuous Authentication: Unlike traditional methods that verify users only at login, this approach continuously monitored behavioral patterns to detect anomalies.

Real-Time Threat Detection: The system identified and flagged suspicious behavior in real-time, preventing unauthorized transactions before they occurred.

Overall Impact

The implementation of behavioral biometrics had a profound impact on Visa’s security and user experience:

Reduced Fraud Incidents:

Visa observed a significant decline in unauthorized transactions and fraudulent activities.

Enhanced detection of compromised accounts, preventing fraudsters from misusing stolen credentials.

Enhanced User Experience:

Passive authentication allowed legitimate users to complete transactions seamlessly without additional security steps.

Reduced friction in the payment process, improving customer satisfaction and trust.

Key Takeaways

Behavioral Biometrics as a Fraud Prevention Tool:

A powerful, non-intrusive authentication method that strengthens online transaction security.

Helps in identifying and mitigating fraud attempts without relying solely on static credentials.

Seamless Security Integration:

Advanced security technologies can enhance protection without compromising user convenience.

Continuous authentication provides real-time fraud detection while keeping the user experience smooth.

Conclusion

Visa’s adoption of behavioral biometrics demonstrates a proactive approach to fraud prevention. By leveraging AI-driven user behavior analysis, Visa effectively mitigated security threats while maintaining a seamless online transaction experience. This case study highlights the effectiveness of behavioral biometrics in reducing fraud, improving security, and enhancing customer trust in digital payments.

Comments

Post a Comment